Life Insurance in and around Bay Shore

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Would you like to create a personalized life quote?

Protect Those You Love Most

Do you know what funerals cost these days? Most people aren't aware that the median cost of a funeral nowadays is $8,500. That’s a heavy burden to carry when they are grieving a loss. If the people you love cannot cover those costs, they may be unable to make ends meet in the wake of your passing. With a life insurance policy from State Farm, your family can live comfortably, even without your income. Whether it maintains a current standard of living, pays off debts or keeps paying for your home, the life insurance you choose can be there when it’s needed most by your loved ones.

Insurance that helps life's moments move on

Don't delay your search for Life insurance

Put Those Worries To Rest

You’ll get that and more with State Farm life insurance. State Farm has terrific protection plans to keep your loved ones safe with a policy that’s personalized to match your specific needs. Thankfully you won’t have to figure that out on your own. With solid values and excellent customer service, State Farm Agent Michael S. Stagnitta walks you through every step to generate a plan that safeguards your loved ones and everything you’ve planned for them.

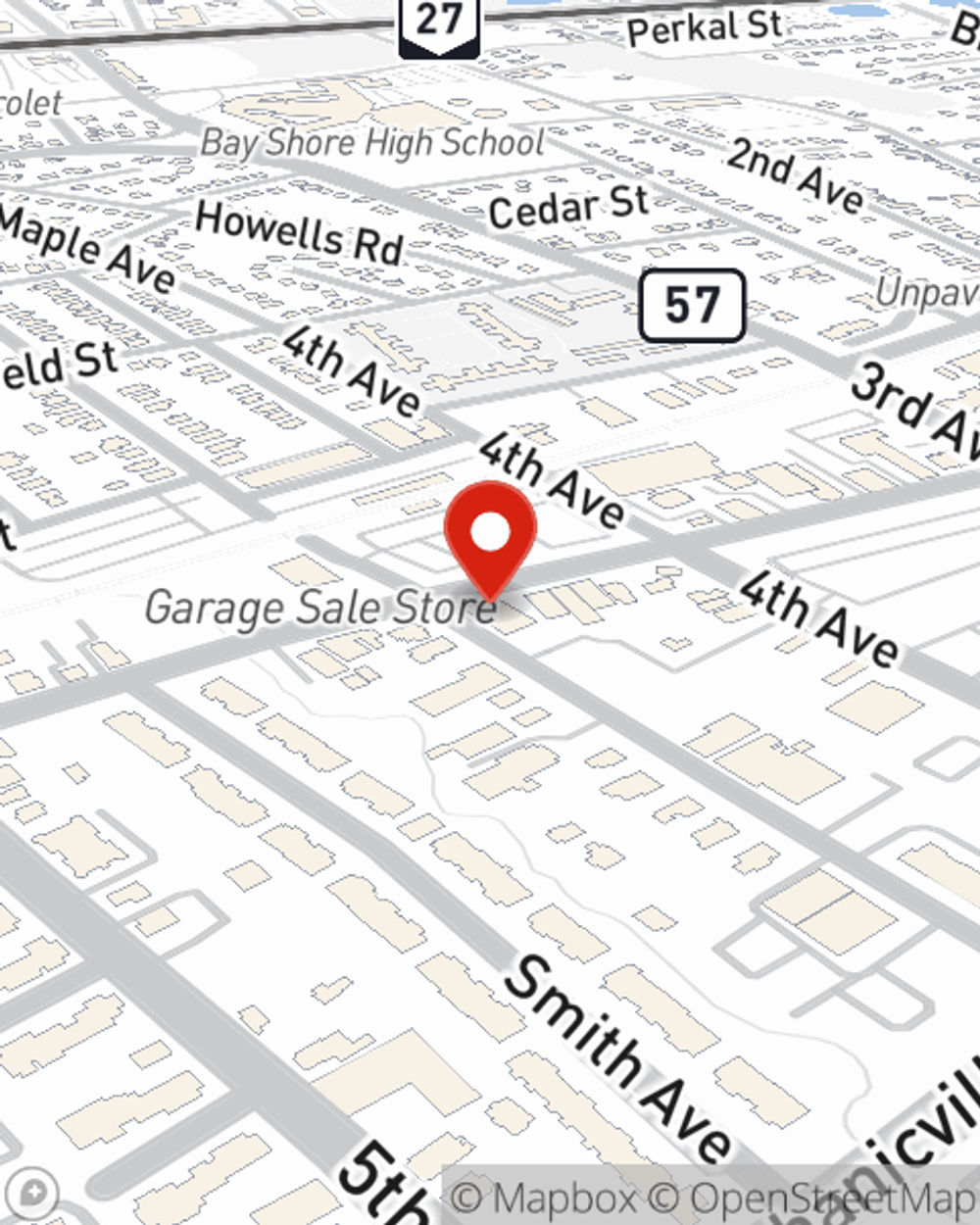

More people choose State Farm® as their life insurance company over any other insurer. Are you ready to check out what the State Farm brand can do for you? Visit State Farm Agent Michael S. Stagnitta today.

Have More Questions About Life Insurance?

Call Michael at (631) 666-8350 or visit our FAQ page.

- Build a stronger well-being.

- Get guidance and motivation to strengthen key areas of your overall wellness.

- Explore estate and end-of-life planning tools.

Simple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.

Michael S. Stagnitta

State Farm® Insurance AgentSimple Insights®

How to create a retirement income plan

How to create a retirement income plan

Creating a retirement plan that works requires a balance of budgeting and savvy retirement income strategies.

Irrevocable life insurance trust for a single person

Irrevocable life insurance trust for a single person

Estate taxes are imposed on all assets in an estate. Pay some of those taxes using an irrevocable life insurance trust.